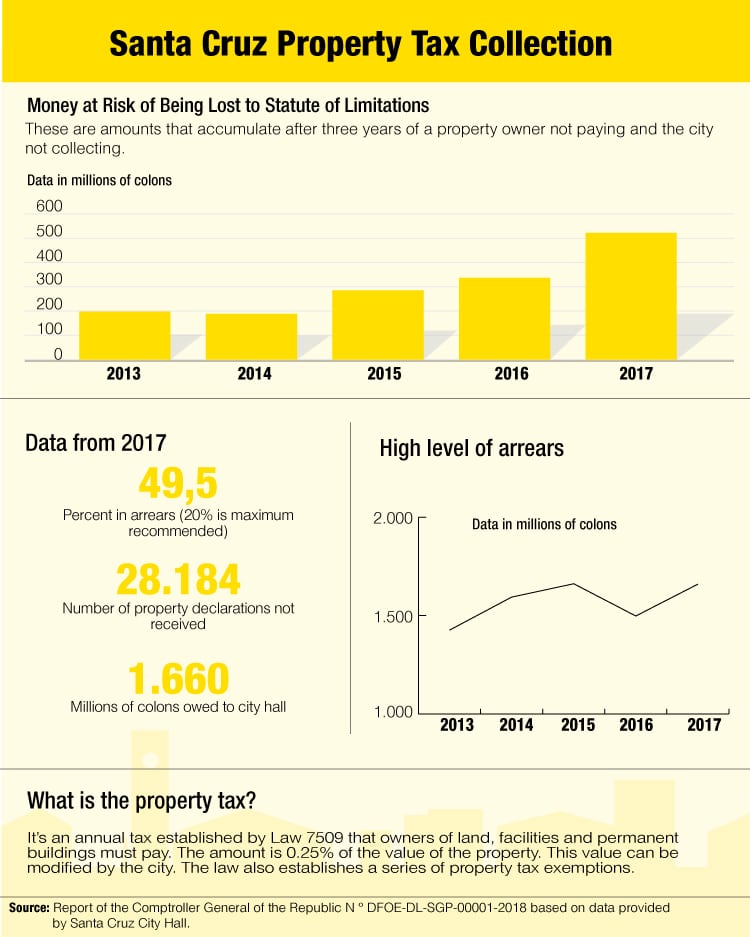

The City of Santa Cruz could lose ¢552 million ($976,000) because of poor tax collection management when it comes to the canton’s property tax.

This is according to a Comptroller General report that analyzes the management, collection and use of this tax in seven cities across the country, Santa Cruz among them.

The mayor and financial director deny that the total is this high and assure that the accounting system the local government uses could be between 30-40 percent “trash” information (for example, it registers properties that never existed).

Property taxes represent an average of 25.4 percent of the total revenue for city governments in the country. It’s one of the biggest revenue streams.

Cities develop projects deemed priorities with this money, including maintenance of roads and highways, education, culture and sport.

How does a city lose ¢552 million? All property owners and third parties have the annual obligation to pay the tax (see chart), according to Law 7509. If the taxpayer doesn’t pay for three years and the city doesn’t collect it, this money runs the risk of passing the statute of limitations.

In other words, the property owner will no longer have the obligation to pay the debt and the city will have its hands tied when it comes to collecting it.

City Shakes

But the statute of limitations isn’t automatic. In practice, the taxpayer doesn’t become exempt of paying after three years. Rather, he must request the exemption at city hall, which reserves the right to reject it.

While he didn’t give exact data, financial director Mario Moreira said that “the majority” of people that request the exemption already have a pending charge, which allows the city to reject the request and argue that the taxpayer, at some point, had already been notified for their missed payments.

Therefore, the city of Santa Cruz says it will not lose ¢552 million, but a smaller amount, although they don’t know how much.

Moreira added that another percent of cases – without specifying an exact number – were elevated to the judicial level so that a court can define whether or not a taxpayer should pay the debt.

“This information gives the impression that all the money is going to be lost and that couldn’t be farther from the truth,” the official said. “The city is going to defend all collection processes.”

“In the last five years, of all the events that have occurred, which are many, maybe one has been recognized as having passed the statute of limitations,” he said.

The Voice of Guanacaste tried to find out what was the exact percentage of money that already has an administrative bill or judicial process, but data was not provided by the time this edition went to print.

Ghost Information

The Comproller’s report was created with information supplied by the city. The financial director as well as Santa Cruz Mayor María Rosa López assure that the pending amount to collect for property taxes is much less than ¢552 million and that they are certain this money will be recovered.

So how is it possible that the information the city provided is incorrect? The local government admits it has problems with information systems and that databases are fed a high percentage of ghost or trash information.

According to the mayor, the databases show a missed payment from a taxpayer that doesn’t exist and this data ends up in the exempt tax totals. But for the comptroller, this information is even more worrying.

“How are they going to know how much to charge if the system doesn’t tell them?” said Vivian Garbanzo, manager of the local development office for the comptroller. “In order to make decisions you have to you have to have trustworthy information.”

As a response, the mayor assures that the city has already considered hiring a professional company in order to clean up the databases. The extraordinary budget calls for an amount of ¢33 million ($58,000) to complete this objective.

“We are working on it,” the mayor said. “Our commitment is to resolve this by the end of the year, and have healthier databases.”

Late Payments Don’t Stop

Beyond the money that is at risk of passing the statute of limitations, the City of Santa Cruz faces another challenge: outstanding payments on property taxes.

According to the Comptroller’s Office, the City of Santa Cruz was owed ¢1.66 billion ($2.94 million) as of December 31, 2017, which includes the ¢552 million at risk of not being collected. This amount represents outstanding payments of more than 40 percent, above the 20 percent considered acceptable by the comptroller.

According to the comptroller, this amount reveals tax evasion. In other words, Santa Cruz residents don’t pay even though they know they have to responsibility to do so.

More Revenue. How?

The Comptroller’s Office gives several recommendations for cities to improve their revenue collection systems.

Amont them is designing a real strategy to recover the amounts owed by taxpayers and clean up and update the information in the databases of the systems associated with tax collection.

Cities must also review the value of properties. This is ultimately what determines how much taxpayers owe for property taxes.

“We are going to work on updating the value of the data on farms,” the mayor said. “For example, there are farms valued at ¢1,000 ($1.80).”

Registering the value of a property can be done through municipal appraisers, where the government also recognizes that it still has work to do.

“We don’t have designated messengers to notify people. Taxpayers are notified by the same inspectors or city police,” López said.

Comments