Rebeca Gutiérrez teaches pre-school and lives with her husband and brothers in the house they inherited from their parents, but they want to move out and live alone.

Rebeca and her husband are professionals and their monthly family income is just ¢850,000 ($1,500). They live in the outskirts of Huacas, Santa Cruz. “We live in a humble house because rent here is very expensive since it is a touristy area,” Gutiérrez said, confessing that she had lost hope of owning her own home because they don’t have enough savings for a downpayment and have credit card debt.

In order for a middle class family in Guanacaste to own their own home through banks like the Banco de Costa Rica and Bac San José, they must pay interest rates between 9%-10.20%, have a clean credit history (without arrears) and a monthly family income of roughly ¢2 million ($3,500) in order to buy a home that costs between $88,000 and $150,000.

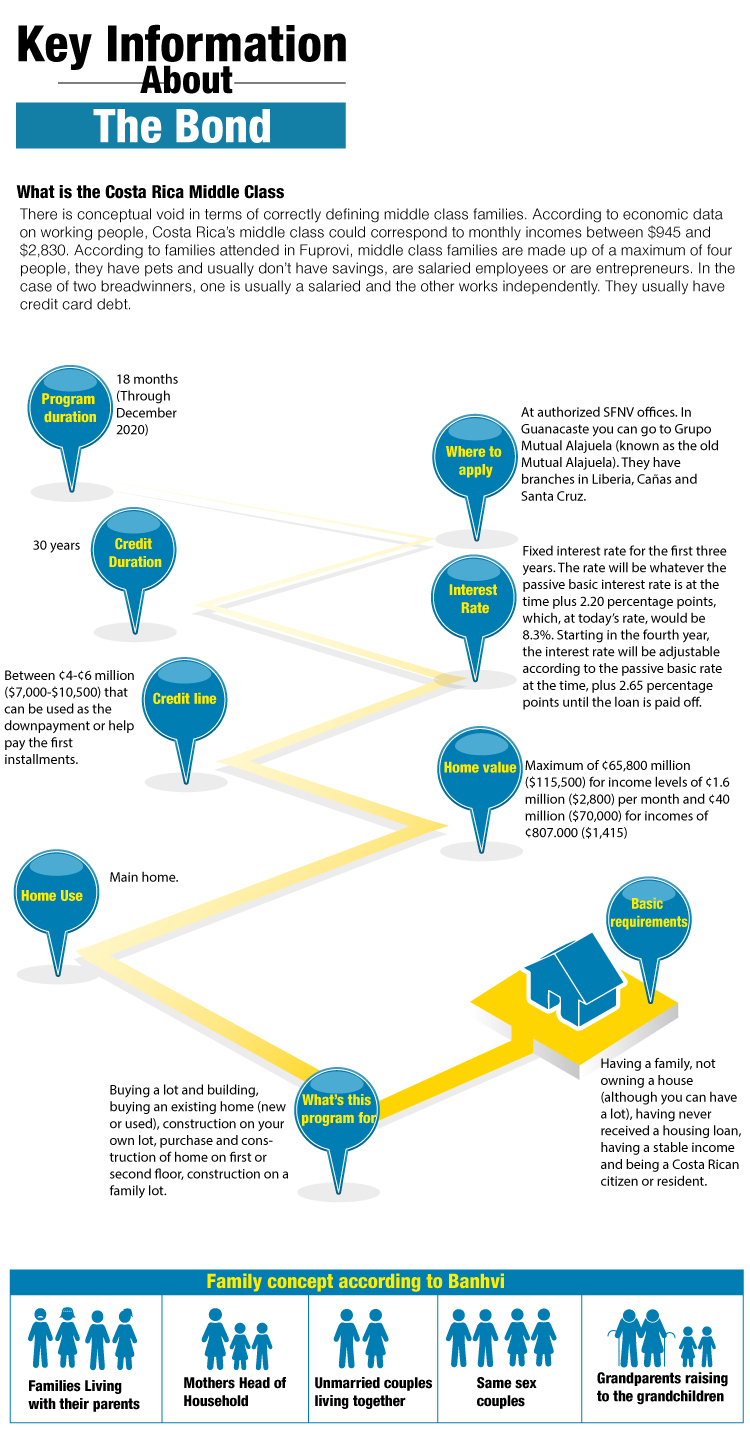

Recently, Banco Hipotecario de la Vivienda (Banhvi), a home loan bank, opened a new line of credit for families whose total income is between ¢807,966 and ¢1,615,932. ($1,400-$2,800).

These families can buy houses that cost up to ($115,500) at with 30-year mortgages at interest rates below those of other banks. They can also get a ¢6 million ($10,500) credit line to help them with the mortgage downpayment.

Marianela Morales Ramírez, from Banhvi’s communications office, said that the goal of this new program is to offer the middle class better conditions for home purchases.

“Previously, credit lines for this segment were ¢3.5 million and now they are ¢4-6 million. The interest rate was lowered from 10% to 8.5% so it’s cheaper. That gives customers more space to pay back the loan because the monthly installment will be lower,” Morales says.

Another change is the more comprehensive concept of the family that uses Banhvi, which ranges from house moms, families that live with their parents, grandparents that raise grandchildren, same-sex couples or unmarried couples.

Problems to Solve

Middle-income families have few options for buying their own homes because there is a shortage of solutions designed for them while poor families and extremely poor families can get credits from different institutions like Banhvi, Invu and aid from municipal governments.

According to the Housing Promotion Foundation (Fuprovi), upper-class families are competing with solutions for the middle class because they can get bigger loans since they have already proved they are “good debtors.”

According to Fuprovi data, homes with incomes of around ¢784,738 ($1,450) struggle even if they qualify for loans from the Family Housing Bond because their credit conditions and debt levels don’t allow them to tap financing.

This problem grows becomes macro when we realize that 51% of the population in the Chorotega region is considered to be middle class, according to INEC data from the 2018 housing survey.

Despite the fact that Law 7052 states that middle-class families can be beneficiaries of the Family Housing Bond, only 10% of its resources are geared toward middle-income families.

Comments