Six companies in the Golfo de Papagayo Tourism Development (PTGP) declared zero earnings to the Finance Ministry’s tax authority in four or more years and, therefore, did not have to pay income taxes. They are all included on a list of 195 large companies published this week by the ministry due to a ruling from the Constitutional Court.

They are the following listed companies, that together represent 15 percent of the 40 licensees in the development, according to a list provided by the Costa Rica Tourism Institute to this newspaper in October 2017.

- Occidental Smeralda S. A. Owner of the Occidental Grand Papagayo Hotel. Eight years with no earnings.

- Ecodesarrollo Papagayo Limitada. Owner of Península de Papagayo development. Largest licensee of PTGP. Seven years with no earnings.

- Florida Inmobiliaria. Holding company for other companies that operate in the development such as North Peninsula Holdings. It reported no earnings for seven years.

- Secreto del Pacífico S. R. L: Seven years without earnings

- Grupo Istmo Papagayo S.R.L: Owner of the Four Seasons in Papagayo. Four years without earnings.

- Hotel Occidental Playa Nacascolo S.A: No longer a licensee as of September. It reported zero earnings for 10 years.

These licensees are considered major taxpayers by the Finance Ministry because they have at least one of the following characteristics: They have paid, on average, more than ¢450 million ($750,000) in income taxes over the last three years, have gross earnings (without legal deductions) equal to or greater than ¢40 billion ($66.7m) or declare assets of more than ¢50 billion ($83.3m).

This means that, while they declared losses or no profits for several years, they may continue on the list because they have land that is worth a lot of money, expensive shares of companies or other assets.

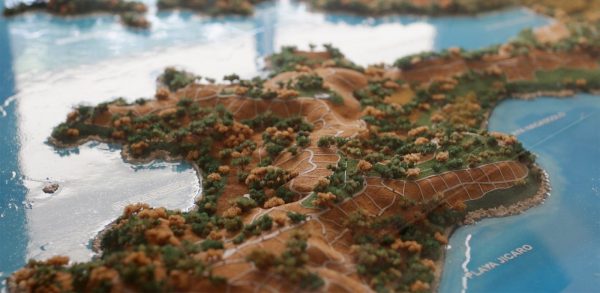

The Golfo de Papagayo is a portion of land that the ICT licensed out to different hotel and real estate companies that sell small tourism packages and houses for living. The hotel companies this newspaper consulted for this story explained that they have invested a lot and they still haven’t seen returns on investment.

The tourism and real estate industry is characterized by long-term investments that require constant injections of capital,” said Manuel Ardón, head of operations for the Peninsula de Papagayo, the name that Ecodesarrollo Papagayo operates under.

Florida Inmobiliaria, which is part of Florida Ice and Farm Company (Fifco), is a holding company with the purpose of holding the shares of its subsidiaries. Fifco clarified that Florida Inmobiliaria didn’t report earnings, but its subsidiaries did.

Zero Earnings Means….

Is this all illegal? Is it unethical? Not necessarily. For a company to report zero earnings in more than one fiscal year doesn’t mean they are trying to avoid paying taxes.

But, according to former finance minister Fernando Rodríguez, this behavior sets off alarms at the tax authority.

Rodríguez calls it “risk criteria.” He says “it’s an element that allows for selecting this company for an eventual audit. There may be an immediate explanation in their financial statements, or other procedures may need to be followed,” he said.

Rodríguez was emphatic that this doesn’t mean the company has used legal mechanisms to elude or minimize the payment of taxes – called tax avoidance – nor has it used illegal methods to do so – known as evasion. It simply means that its an element that makes the tax authority question what is happening.

For example, Ardón told this newspaper that his company Península de Papagayo has been audited by the Finance Ministry on three occasions.

The ministry didn’t give names but said that 96 companies on the list have been audited and the tax authority could claim ¢560 billion in taxes from them. There are also seven criminal complaints and another ¢1.5 billion that could be recovered through court proceedings.

The Case of Ecodesarrollo

One of the names that appears on the ministry’s list is the only “master” licensee, or major licensee, at the development. It’s Ecodesarrollo Papagayo S. A.

The licensee was also at the center of an investigation published by The Voice of Guanacaste in November 2017 for stashing its loans, earnings and transactions in countries like the Bahamas, the British Virgin Islands, and the Cayman Islands, which aren’t just out of the reach of the Costa Rican tax authority, they don’t charge taxes on these kinds of activities.

The licensee reported zero earnings in Costa Rica during some of the years that it also made transactions in tax havens.

But Manuel Ardón, the head of operations for Península Papagayo (trade name for Ecodesarrollo), said that different national and international events like the real estate crisis of 2008 have affected the tourism and real estate industry, having an impact on the development.

He also said that Península Papagayo has gone through different stages of investment, renovating and improving its properties, which translates to zero earnings in six of the last 10 years.

It’s important to mention that during the period in question, we have been audited by the government, we complied with the procedures requested by the Finance Ministry and they have been adequately received in all periods,” Ardón said in a response to this newspaper.

Everything Happens in Papagayo

The Golfo de Papagayo Tourism Development (PTGP) was a zone Costa Rica came up with in the 1970s as an engine for investment in Guanacaste, but it hasn’t demonstrated its impact for Guanacaste or for the country.

The ICT told this newspaper in October 2017 that 97 percent of the development is licensed out. If that’s the case, then licensees haven’t finished developing works and the majority of them have been present for more than 10 years.

At that time, of 40 licensees in the development, only 12 reported their projects as complete.

Finance Ministry Wants a Breath of Fresh Air

The list was revealed at a time when the Finance Ministry has better tools to fight evasion and reduce avoidance due to a fiscal reform package recently approved in Congress

“It’s a happy coincidence,” said Rocío Aguilar in a press conference.

It’s very common for big companies to invest large sums of money in well-known law offices or even to have entire departments dedicated to “fiscal planning,” which is the most politically correct term for using legal loopholes that allow major taxpayers to pay the lowest possible amount of taxes.

Whether or not it’s ethical and, above all, damaging for the country is a discussion the entire world, Costa Rica included, is having, in which the inefficiency of the tax authority (which the Finance Ministry admits) and the very relaxed tax laws allow the richest to find alternative ways to not pay taxes that the middle class must pay because they are automatically withheld from their salary or incorporated in products that we buy at the store.

Fernando Rodríguez, former deputy minister of finance, mentioned the need for substantial changes like worldwide income, for example, in order to keep auditing eyes on people beyond Costa Rican territory.

In these terms, the more the better,” he said. “You can never be satisfied with the regulation that you have. The reform that was approved is good, but it’s only part of it. There is still a lot left to improve.”

Comments