Tax havens help keep secrets. We discovered just one of many.

The company that serves us ice-cold beer at the cantina, Fifco, says that its presence in tax havens was a temporary visit fed by the insistence of the Schwan Foundation, its friend in the largest project in Papagayo: Ecodesarrollo. Mom would ask, if Schwan told you to jump off a bridge, would you do it?

Since Fifco doesn’t have a mom, field specialists say it to them: very few takes the time to take billions of dollars out of Costa Rica, create seven, eight, nine shell companies in tax havens, pay four or five different law firms for those transactions so at the end of the day it can invest in a project that it has in Costa Rica, if it isn’t winning something big.

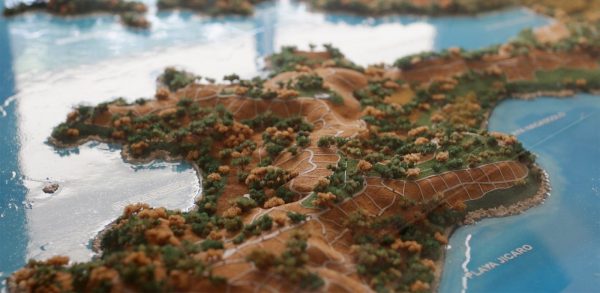

On that very flat, but very disputed land, Fifco, Schwan and several hundred other business owners decided to play.

READ ALSO: Offshore Trove Exposes Trump-Russia links and Piggy Banks of the Wealthiest 1 Percent

At this point we must clear something up: None of this would matter to us if it weren’t the case that those luxurious hotels and houses and golf courses of Ecodesarrollo’s were built on land that belonged to the state. In other words, land that, like it or not, belongs to Guancastecans and all Costa Ricans.

Being fair, we must say that taking your money to a tax haven doesn’t equate to doing something illegal, but at its core this isn’t a discussion about what’s legal or illegal, nor about what’s moral or immoral. Rather, it’s about what stays secret and out of the reach of tax authorities and Ticos who, we repeat, are the owners of this land.

This is a discussion about transparency, about what we have the right to know but never would know if it weren’t for the leaked dossiers that we had access to: Panama Papers and Paradise Papers.

READ ALSO: Largest Papagayo Investors Dealt and Stashed Money in Tax Havens

In order to understand the mess that Fifco got itself into —which isn’t uncommon among those who have more money than all of Guanacaste’s middle class members combined— this newspaper submerged itself in thousands of files that were hidden in the British Virgin Islands and the Bahamas and that only came to light publicly along with millions of other documents because, at some point, someone who had access to these secrets decided once and for all to share them.

Perhaps we didn’t uncover a corruption scandal here like that of the imported Chinese cement, but we know something that we want you to know too, and that’s that the richest people are able to take their money to other countries that don’t charge taxes in order to avoid paying them here, where others like us in the middle class continue paying our fair share, even though it may be just because we have no other choice. Never will the phrase “paying for the sins of others” be better employed.

As it sometimes happens with secrets, one could think that it would be better to stay completely ignorant rather than to know something that is only going to ruffle your feathers without having the ability to do anything about it, but that’s the first mistake. Something can always be done, above all now with presidential elections just around the corner.

Before you get mad because you think we are going to talk to you about politics, we aren’t. We are just going to say this to you: Pay attention to the candidates that talk about income taxes, the fight against tax fraud, transparency and tax laws in general. Those candidates —and not the ones that lie and say it’s not necessary to discuss this topic because it’s very complicated— are the truly brave of our time.

Comments