“We need more free trade zones to revive the economy and generate more jobs in Guanacaste.” Several candidates for mayor of Santa Cruz and participating citizens affirmed that in a debate, but do we know how many benefits the free trade zones are really generating?

According to data analyzed by The Voice, there are only nine companies in the province under this system that only generate 1,003 jobs.

Free trade zones (FTZ) are a model that Costa Rica uses to attract more investment and employment. In return, the country grants a wide range of benefits, including exemption from export taxes, sales taxes and municipal taxes. The level of investment is defined by the authorities for each specific case.

The Foreign Trade Promoter (Procomer) ensures that for every dollar exonerated, Costa Rica receives an additional 150% return. This refers to what remains in the country in salaries, purchases from national businesses, social charges, etc. But in Guanacaste, Procomer does not know if that same percentage of return is met.

Low impact

Cañas, Bagaces, Liberia, Carrillo and Nandayure have at least one company under this system. In total, there are nine that generate 1,003 jobs, less than 1% of Guanacaste’s total number of jobs.

Those 1,003 direct jobs also represent 1% of those generated by all of the country’s free trade zones, which places us in last place out of the seven provinces.

Meanwhile, the province continues to have the third highest unemployment rate in the country, according to the National Institute of Statistics and Census (INEC). In Guanacaste, about 142,000 people are employed and about 22,000 are unemployed. To “solve” the unemployment problem, Guanacaste would have to generate 22 times what it has so far in free trade zones, but that is not an easy task.

“It’s not as simple as saying ‘I’m going to make a free trade zone park’ and copanies are going to show up,” argued Solarium’s commercial director Gabriela Mata.

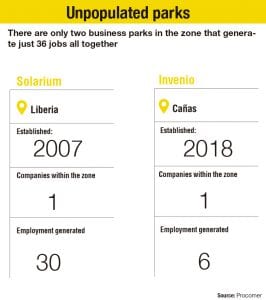

Solarium, located across from the Daniel Oduber Airport in Liberia, is an extensive business park with 78 businesses already set up there. Within the project, there is also a free trade zone park, which initiated about 13 years ago as the first in the province.

Free trade zone parks are administrative entities with previously existing facilities (four warehouses in Solarium’s case) that already meet all the conditions and have government permits to bring companies that operate under the system. The firms move into and rent these spaces.

To date, in the Solarium free trade zone, only one company has moved in there, with 30 employees. However, having a FTZ has served more as a hook to attract other companies such as Coca Cola. “It is a tool to position the project also,” she said.

Invenio University, located in Cañas, has a sister development: a 80-hectare (200-acre) free trade zone that was established in 2018.

At the moment, there is only one company located there with six employees. Its operations director, Pietro Malavasi, explained that they created the FTZ in response to the Invenio University model.

“Our dual training system requires companies and we thought of a technological cluster. We said, ‘Why don’t we adjust the project in a way that allows us to have training companies on the same campus?’” Malavasi said.

What Is Urgently Needed

“If we do not have the necessary conditions in the regions for the investment to be established, it will be very difficult for us to go out and promote the country and the region,” said Cinde’s Investment Promotion and Capacity Development Manager for outside of the greater metropolitan area, Yahaira Barquero. She agrees with other people interviewed: we lack human capital in Guanacaste.

The two free trade zone parks set up in the province face this problem. The fact that more companies have not moved in is mainly due to the lack of people trained for what companies require.

What makes it difficult to accelerate growth is that we need labor. We have the base elements. All we need is to be able to train people at the pace that companies demand,” commented Malavasi, from Invenio.

According to the State of Education IV report, the universities in Guanacaste continue to focus on training talent in traditional careers such as tourism, administration, education or law and not in careers in strategic production areas such as engineering.

They are also concerned that people don’t speak much English. “If a company comes and tells me: I need 200 people who speak English for me to hire them now and an English program that guarantees me 500 people a year to have a volume of growth, what do you say? I don’t have it,” said Mata, from Solarium.

They are also concerned that people don’t speak much English. “If a company comes and tells me: I need 200 people who speak English for me to hire them now and an English program that guarantees me 500 people a year to have a volume of growth, what do you say? I don’t have it,” said Mata, from Solarium.

In 2016, the Fight Poverty Via Employment in Guanacaste project report, from the Positive Horizon association, indicated that 95% of the adult population in the province does not speak a second language.

The level of English is exactly what worries Suk Lin Ajú, the commercial manager of the company Melones de la Peninsula. His company opened a sister company under the free trade zone system in Nandayure in November 2019 and he said they want to hire about 40 people, but they doubt they can find the profile of the people they need.

We would like to think that we are not going to have a limitation in our growth but it is something we see with concern,” Ajú commented.

The company they created, JH Biotech, is a subsidiary of Jianghuai Horticulture Seed Co. of Anhui, China, that works out of Costa Rica on the generation of hybrid seeds of different varieties of watermelon, melon, squash and chili peppers.

The Route to Follow

In 2010, the country announced a reform of the Free Trade Zone Law that established differentiated benefits for companies that choose areas outside the greater metropolitan area as their operation centers.

Even with the reform, the pace of companies moving in remains slow: less than one company set up per year in Guanacaste since then.

Cinde and Procomer say that while the process is slow for a company to decide to set up in a region (it can take up to seven years), this slowdown demonstrates the need for others, such as local governments, to actively join the process of attracting businesses.

How could they do that? According to Barquero, from Cinde, the first thing that municipalities should be doing is to carry out a self-diagnosis to find out how ready the canton is to take that step.

In Guanacaste, Cinde selected two municipalities to work on that process: Liberia and Carrillo. The rest of the municipalities lack a similar plan, although the institutions say they can opt to self-diagnose whenever they want.

This self-diagnosis, called the Investment Guide, is a kind of checklist for variables such as connectivity, water supply, road infrastructure, etc., that allow them to define what the weak points are and propose what they should do to attract more companies.

For example, a company thinks, where am I going to take my general managers? Will I have access to private medical care? How quick are the procedures in the municipalities? All these issues add up for a company to make the decision to be outside the greater metropolitan area,” pointed out Mata, from Solarium.

The participation of other stakeholders is also necessary for this investment guide. Cinde points to the Northern Zone as a good example, as it is a region where the community, the public sector, the municipality and the production sector created an alliance to increase their competitiveness.

“The Northern Zone has had a development agency for about 20 years. It is an example of the result of making an agreement and being assertive in the execution and identification of projects. And that is perhaps the biggest challenge in Guanacaste,” Barquero commented.

For the Future

Everyone consulted for this article believes that the free trade zone system can grow in Guanacaste.

Mata, from Solarium, says that many other projects have become interested because they want to invest in the province, motivated by the Coca Cola plant set up in Liberia.

“A very interesting process is coming and it is that of commercial chains. There are many companies that supply the plant with raw material and within the experience, they are likely to begin to see the economic impact of moving products and logistics to the zone and evaluate opening operations in Liberia,” Mata related.

Invenio also envisions a good future. “If the question is whether we see fertile ground, the answer is yes,” said Malavasi.

Comments